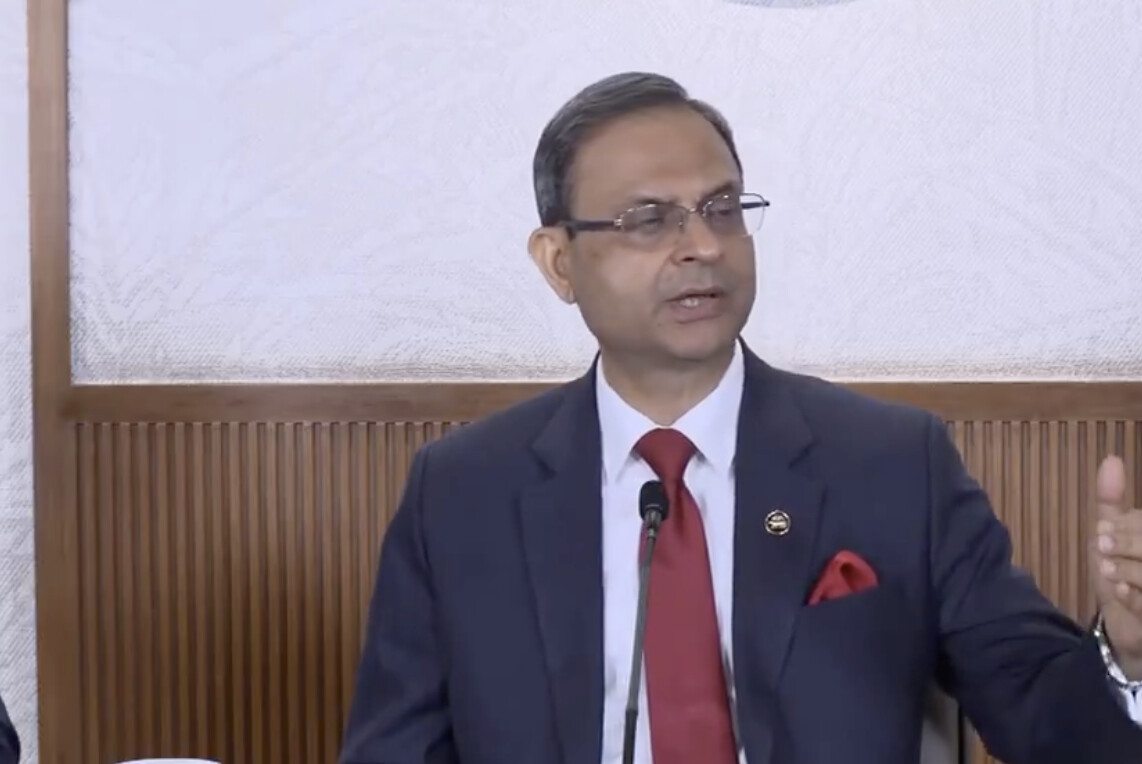

Mumbai: Reserve Bank of India Governor Sanjay Malhotra on Tuesday said that the government’s gross market borrowing is expected to increase in the coming financial year due to higher redemptions, but stressed that the net borrowing numbers remain stable and manageable.

Speaking to the media in Mumbai, Malhotra said that while the gross borrowing calendar for the upcoming year will be higher than the previous year, the increase is largely driven by redemption obligations. “We have been looking at the gross numbers. There are many more redemptions in the coming year than last year. So, as a result, the gross calendar will be higher,” he said.

The RBI Governor urged a focus on net borrowing figures rather than gross numbers to get a clearer picture of the government’s actual financing requirement. “If you look at the net numbers, the government securities borrowing programme is 11.53 lakh crore. In the coming year, it is expected to be 11.73 lakh crore,” Malhotra said, indicating only a marginal rise.

He further stated that the government plans to raise part of its funds through treasury bills in the year ahead, which will help in managing liquidity conditions and the yield curve more efficiently. “In the year to come, money will be raised through treasury bills. It will help manage the yield curve more effectively,” he said.

Commenting on small savings, Malhotra said that the budgeted estimates in this segment are conservative, suggesting limited pressure on market borrowings from this source. He added that such an approach provides greater predictability and stability to the overall borrowing programme.

Market participants closely track government borrowing plans as they have a direct impact on bond yields, liquidity, and overall financial conditions. Analysts said the RBI Governor’s remarks are likely to reassure investors that despite higher gross borrowings, the government’s fiscal strategy remains disciplined and focused on maintaining macroeconomic stability.